Auto component sector sees record turnover of Rs 4.2 trillion in FY22: ACMA

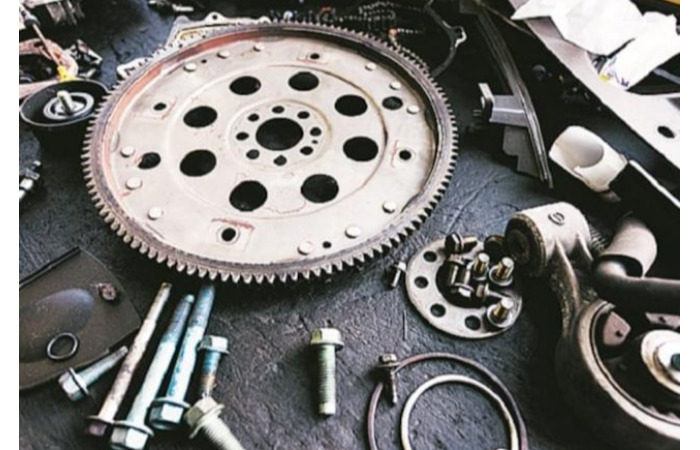

Indian auto components industry clocked its highest-ever turnover of Rs 4.2 trillion in 2021-22, registering a growth of 23 per cent on the back of strong performance in exports and aftermarket, industry body ACMA said. Aftermarket denotes the market for auto components that are used to replace the original auto parts when they are not functioning properly.

At a virtual press conference, Automotive Component Manufacturers’ Association of India (ACMA) stated while auto parts’ imports rose 33 per cent in 2021-22, exports grew 43 per cent in the same period. The auto component industry in India exported components worth Rs 1.41 trillion in 2021-22, it said, adding that auto parts worth Rs 1.36 trillion were imported in 2021-22.

Around 30 per cent of total auto components’ import is from China, giving it the number one position. Germany is the second-largest source of auto parts for India, accounting for around 11 per cent, ACMA noted.

“North America, which accounts for 32 per cent exports, saw a 46 per cent growth. Europe, accounting for 31 per cent and Asia for 25 per cent, respectively, grew 39 per cent and 40 per cent,” ACMA noted.

Key items exported in the last financial year were drive transmission and steering, engine components, body, chassis, suspension, and brakes. The turnover of auto components’ aftermarket stood at Rs 74,203 crore in 2021-22, clocking a growth rate of 15 per cent over the previous year. The aftermarket’s turnover crossed the pre-pandemic levels in 2021-22 because of more vehicles on road, prolonged usage of vehicles, increase in demand of second-hand vehicles, increase in commodity prices, and emergence of new sales channels such as online retailers and multi-brand outlets, ACMA noted.

ACMA said shortage of chips, high raw material and logistics cost, availability of containers for transport of auto components, increasing inflation, rising fuel prices, high insurance cost, less than expected growth in two-wheeler segment and high GST rates on auto components are some of the headwinds the auto component industry is facing in the country. However, it also mentioned that the sector is also getting the benefit of multiple tailwinds such as high estimated GDP growth in 2022-23, strong demand in domestic vehicle market, surge in exports, focus on clean and new technology, states’ electric vehicles policy and the government’s production-linked incentive (PLI) scheme.

+91-22-24193000

+91-22-24193000 Subscriber@ASAPPinfoGlobal.com

Subscriber@ASAPPinfoGlobal.com