Building a strong foundation

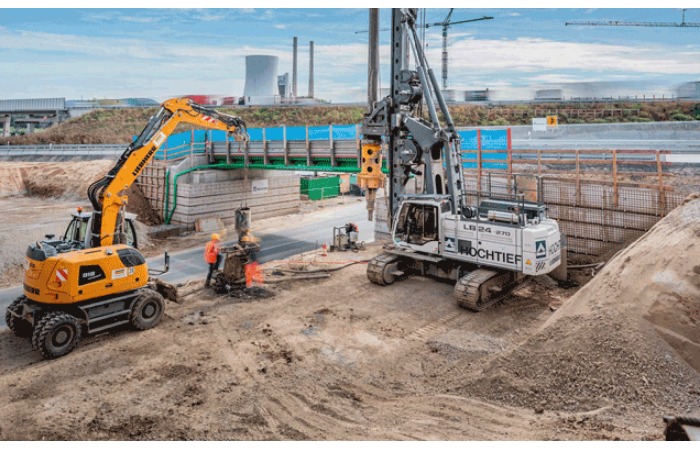

Foundation equipment, also known as pile driver equipment, is used to drive piles into soil to provide base support to bridges, buildings and other large infrastructures. A heavy weight is placed between guides allowing it to move up and down in a straight line. Once placed upon a pile, it is raised using diesel or hydraulics. Its components include diesel hammer, hydraulic hammer, hydraulic press-in, vibratory pile driver, piling rig, etc. In traditional foundation equipment, manual labour and animals are used to lift heavy loads. With the advent of new technologies, various methods such as diesel hammer, hydraulic hammer, and hydraulic press-in are used to raise the weights.

The market size of the foundation equipment in India is estimated to be Rs 150-170 crore. The size of the market is well“expected to grow up with number of port projects lined up for green field and brown field expansion. Growth would also be catered by underground metro railway projects added with overall development of core infrastructure and real estate projects lined up.

Policy paralysis has made a major dent in demand for foundation equipment. A sluggish mood prevails over this industry segment. But the silver lining is that slow times are making construction companies more conscious about productivity and demanding of latest technologies.

The demand for foundation equipment in India is backed by continuous effort for modernisation of infrastructure. Major demand for foundation equipment comes from construction projects such as roads, metro, railway, power plants, special economic zone, mining and water and irrigation sector.

Sany Heavy Industry (India), MAIT India, Bauer Equipment India, Casagrande (India) Piling & Geotechnical Equipment, Thyssenkrupp, PRD Rigs, Schwing Stetter, Ashok Industries and GeTech Equipments are some of the players competing in the Indian market on various grounds such as customer base, geographical presence, technology, repair and maintenance, product portfolio, etc.

According to a spokesperson from Suretech Infrastructure, The demand for foundation equipment was subdued in 2020. However, growth in the construction industry is forecast to be strong, with output values across much of the industry expected to recover to their pre-pandemic levels by 2022 due to pent up demand.

Suretech Infrastructure offers specialised infrastructure construction and foundation engineering equipment and materials to the building and construction industry, throughout the Indian Sub-Continent.

Karan Chechi, Research Director, TechSci Research, says, Several government initiatives such as development of urban infrastructure including metro rail projects, ports, industrial corridors and freight corridors are anticipated to boost infrastructural development in India. The focus of this will be to improve the connectivity by train, air, water and roadways. Additionally, the focus on smart buildings is constantly increasing in India, which is majorly attributed to the rising population, increasing urbanisation and improving lifestyle. Also, demand for affordable housing is increasing with rising income levels. All these are expected to provide a promising future for the foundation equipment market.

The demand for foundation equipment in India is cyclic in nature, it will grow for two to three years at the rate of 20-25 per cent and then for next one to two years, it will remain flat. However, the major demand of foundation equipment will come from metros, MTHL and other important government projects, says Sanjay Saxena, Director, Heavy Equipment Business, Sany Heavy Industry India.

Demand for foundation equipment is currently shrinking, concurs DV Brahme, Regional Manager, Mait India Foundation Equipment. We expect this trend to continue for a few more months in view of the upcoming monsoon in the western part of the country. Some positive change might happen if the government takes favourable steps for infrastructure development in the next couple of months. Then the market may see some revival in demand by this August or September. Of course with the passage of the financial bill and more positive steps expected from the government in view of the upcoming general elections we hope to see an upward trend in demand for foundation equipment soon.

Salient trends

Notwithstanding the slowdown a few salient trends are influencing demand for foundation equipment. Structural designers are progressively opting for bigger diameter piles, observes Brahme. In favourable site conditions where ample open space is available opting for piles of bigger diameter reduces the number of piles required for getting the same load-bearing capacity and therefore cuts down construction time. As a result the requirement for bigger rigs is on the rise.As an example the medium-sized HR180 MAIT rig with 200 kNm torque used to be the company's most popular machine-for drilling piles of maximum diameter 1200 mm and 1500 mm. Now however MAIT is getting more enquiries for bigger rigs such as the HR260 MAIT with 260 kNm torque, which is suitable for drilling piles of 2000 mm and even larger diameters.

Clearly slow times are driving Indian construction companies to reconsider their choice of piling equipment most often in favour of more productive and cost-effective models.

Major piling equipment includes auger piling equipment bored piling equipment driven piling equipment vibro flotation equipment and sheet piling equipment.

Of these, auger equipment can be hand-operated in this case it is mainly used for small buildings and structures. It includes CFA with hydraulic drilling rig which is suitable for bigger piles used in soil but of no use in rocky areas. Bored piling equipment includes the conventional slow speed method employing tripod and winch with bailer and chisel. Truck-mounted rigs with boring arrangement are more productive but of no use in hard soil or rock. Also they can work only with piles of restricted lengths and diameters.

Modern bored piling equipment hydraulic drilling rigs of different capacity with various attachments is by far the most versatile method of piling. With this machine larger diameter and long piles can be installed.

Expanding range

In foundation equipment, Sany Heavy Industry India offers small sized rigs for soft soils SR155 and SR205; mid-sized and higher depths - SR235, SR265, and SR285; and big sized and for hard rock SR365, SR405, SR445, and SR485. We already have a vast range of piling rigs, however, to serve our customers better we will be introducing some more models in near future like SR185, SR215, SR245, SR335 and micro piling, adds Saxena.Sany rigs are generally heavy in weight which increases the stability while operation. Also, crowd force of Sany rigs is maximum, which helps us cut through the rock very easily. The company uses renowned engines in its piling rigs, which help increase its efficiency by almost six per cent more than its respective competition. This also helps in low fuel consumption while operating rigs. We use auto calibration mode which helps in accurate vertical drilling.

MAIT rigs are most preferred and coveted equipment because of ease of operation and maintenance, coupled with unmatched service as well as spare parts support. MAIT rigs are multipurpose equipment that can be used for different foundation techniques like bore piles, CFA piles, diaphragm walls, stone columns, driven piles, cased CFA piles, SDA piles etc. MAIT HR180 and HR260 are the most popular rig models depending upon the soil profile, which are suitable for drilling 2 m diameter and 40 m depth. Currently, there are more than 500 units of HR180 and more than 40 units of HR260 rigs operational with Indian customers.

Casagrande piling rigs have found applications in many construction projects across the country. Prime among this includes, construction of underpass section in New Delhi by Valecha Engineering. The company is using a Casagrande B125 with a KRC1 Diaphragm Wall Kelly Bar. The piling rigs have been finding usage in construction of DMRC projects.

Though it may take some time for the existing foundation equipment to get fully assimilated in the upcoming projects paving demand for newer equipment, the manufacturers can expect to get benefitted by rendering support to their existing fleet of equipment through timely parts and services support. However, it will be pertinent to expand and strengthen market network to enhance brand recognition.

+91-22-24193000

+91-22-24193000 Subscriber@ASAPPinfoGlobal.com

Subscriber@ASAPPinfoGlobal.com