Gaining traction

Use of aerial work platforms (AWPs) is gaining importance in the changing operational conditions. After the onset of Covid-19 pandemic and the subsequent lockdown, the overall operations came to a standstill for a couple of months and then started recovering with the easing of lockdown. Currently, most of the industrial and market operations are back, though the pandemic is still there. In the pandemic scenario, availability of labour has become an issue in many areas. AWPs play an important role in infrastructure sector, with a higher scale of safety and productivity compared to traditional way of working at heights using more manual force.

Aerial work platforms are used in construction, transportation, and other infrastructure and government projects. These are safe and convenient devices, which make them useful for construction and maintenance operations.

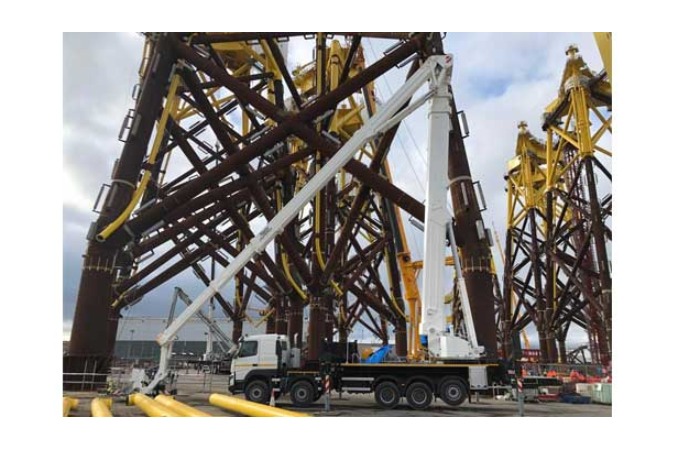

AWPs are being used across the segments including infrastructure, construction, power, oil and gas, facility management, maintenance, buildings, hospitals, malls, hotels, etc. Wherever people need to work safely at heights, AWPs are necessary. In India, the use of AWPs is still in its nascent stage. Nevertheless, with the growth of awareness, people have started preferring AWPs to traditional methods of accessing heights since it is directly related to safety and productivity.

According to Souma Ray, Director, Haulotte India, the demand of AWPs needs to be divided between new and used machines. He adds, “Power, construction, infrastructure, in-plant maintenance, shipyards, and manufacturing sectors mainly fuel the demand for new machines. The rental industry albeit with few players buying some new machines is mostly into used machines.”

Sujai Pujari, Founder & Director, and Balasubramanian Ganapathy, CEO, Daedalus Lift & Access Equipments, said, “The current demand for AWP in Indian market is in a few hundred and it is growing over 40 per cent year-on-year (y-o-y), including new and old machines. The demand is continuously on the rise as many of the Indian origin companies are demanding safe solutions to work at heights. AWP gives complete safety to work at heights. Mainly rental companies, power sector (generation, transmission and distribution), construction companies, food processing units, manufacturing companies, facility management companies, etc, play a major role to drive continuous demand of AWPs.”

In India, the AWP market is dominated by rental segment with a large share of used equipment. The end-user market generally own new machines being imported. According to Ray, the estimated share between end user owned vis-a-vis rental segment is 30 per cent and 70 per cent, respectively.

Though the market for AWP in India is on the rise, the share of new equipment has not picked up satisfactorily over the years. Ray explains, “While demands in other markets have grown exponentially over the period of last 4-5 years (China from 300 machines in 2016 to over 50,000 machines in 2020), in India we are still in the range of 150-350 units during the same period, considering the reputed worldwide brands. Thus, essentially the market in India hasn’t grown much.” Ray highlights the major reason for this is lack of legislations whilst working at height and the unhindered import of cheap used machines of any age and condition. “Whilst many developing countries follow a strict norm of limiting the age of used machine import, we in India have no such embargo,” he points out.

Pandemic impact and recovery

The Covid-19 pandemic has deeply affected all business sectors across the world including the AWP segment. The pandemic and the extended lockdowns that followed have punctured India’s economic growth in Q2 and Q3. According to Ray, the economy is likely to witness it’s sharpest-ever contraction in 2020. “However, the bright side is that in the past three months, things have started becoming better and the demands are picking up again, which is an encouraging site,” he adds.

About the recover path, Ray feels that the year 2021 would be a year of challenges and consolidations. “The recent growth momentum is unlikely to be sustained, and we expect economic activity to return to pre-Covid levels only in 2022,” he adds.

With industrial activities picking up gradually, equipment demand is on the rise. Ray observes, “We expect the demand of AWPs to pick up in the coming months. With the increase in the pace of activities across sectors, the requirement of AWP would see an increase. We are already noticing the trend since the past two months, which is a heartening trend.”

On a positive outlook

Says Pujari, “We have the advantage to create awareness of AWPs in the Indian market by showing the live demonstrations in our factory as well as on-site demonstrations. We believe that personal experience matters a lot in taking decisions in the case of AWPs. We have a pan-India distribution network as well to reach out to maximum customers and give them proper AWP solutions. In addition, we conduct training sessions for our customers and distributors to make them comfortable in handling AWPs.”

Though the Indian AWP market is still in its infancy, there is a lot of room for growth in the coming years. With many mega projects coming up, there will be requirement of advanced machines where AWPs will play a major role for productive and safe operations at project sites. Traditional equipment and conventional methods will pave the way for AWPs.

Ray says, “Hopefully, going forward as the AWP industry matures in India and people become more aware about the multifarious advantages of using such an equipment, the AWP industry shall start seeing a steady growth. In my opinion, in the next five years, this industry shall evolve to become one of the fastest developing sectors.”

The

changed market conditions demand for a very new approach focusing more on

technology and innovation. In the changing scenario, it is expected that AWPs

could play a more important role in the country’s infrastructure creation and

maintenance.

+91-22-24193000

+91-22-24193000 Subscriber@ASAPPinfoGlobal.com

Subscriber@ASAPPinfoGlobal.com