National Capital Goods Policy 2016

The National Capital Goods Policy 2016 has been the talking point for some time now. It is a policy that is not short on intent. It is conclusive but not entirely comprehensive. Some critical elements have been surprisingly left out. However, this policy was a much-required initiative, given the current situation. It may not address all the ills but it will provide some impetus to the sector. This sector is extremely critical for the future of India?s economic story over the medium term.

Capital goods sector in India

The Indian capital goods industry is one of the primary engines of precision manufacturing in India. The capital goods industry is always integrated with the core sector industry on the heavy side and the engineering sector on the downstream side. Currently, the size of the capital goods sector in India is estimated at $96 billion and accounts for nearly12 per cent of the overall manufacturing sector. At net present value, this translates to approximately 2 per cent of GDP. Domestic production of capital goods in India is estimated at about $35 billion. The sector employs nearly 1.5 million people across the value chain. For a large country like India that has a huge import bill, this sector aids in improving trade balance if local manufacturing is improved. This sector has been stressed for a while.

The economics of this business is the fine balance between assets deployed on ground and additional assets that are required continually to meet the business objectives of the industry. There was a distinct inaction by way of policy in the Indian administration for a long time. Investors put assets on ground with a hope that positive policy will allow assets to sweat and in turn create demand for more. In reality, the assets have been idle/unused since the last five-six years. They have not been able to justify RoI. As a result, the size and cost of debt has increased within the Indian financial ecosystem. It will require for a huge uptick in industrial activity to create additional demand in this sector.

Challenges faced by the sector

The three major challenges facing the sector are: inconsistent domestic demand, technology & skill availability, and tax & duty structures.

Inconsistent domestic demand: There is inadequate capacity expansion in the manufacturing, infrastructure and utilities industry in India over the last few years primarily due to policy issues, institutional issues such as inadequate inter-ministerial coordination, etc. Projects were stalled for a variety of reasons.

Contractual clauses in public procurement policy inhibited domestic production and in turn has reduced domestic value addition.

Permission to import second-hand machinery discouraged domestic production. The provision of a zero-import duty concession for several items imported under the ?project imports? category discouraged demand for domestic products.

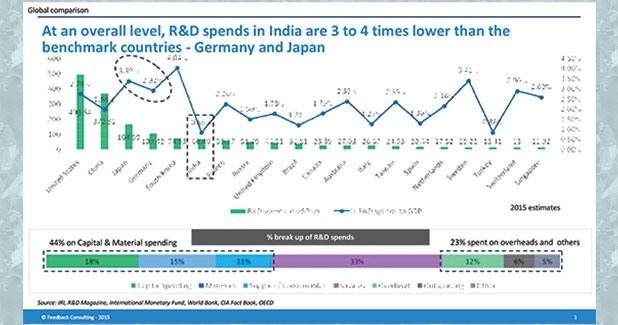

Technology & skill availability: While the sector is a pivot to industrial development, India?s capital goods production has been historically plagued by a variety of issues due to lack of latest technology. Inadequate technology depth is a critical problem. This is primarily due to policy failure. R&D spend in India is pegged at about 0.9 per cent of GDP. This is seriously low when compared to countries as small as Taiwan or South Korea. In India, the government spend on R&D accounts for 60 per cent of total national spend, while industry spends 36 per cent. In developed nations this is exactly the opposite. Within the government spend of 60 per cent, only 6 per cent is spent on manufacturing.

Tax and duty structures: The capital goods sector is plagued by tax structures that are skewed and inappropriate. Buyers are paying lower import duty on finished capital goods that are imported, while manufacturers of capital goods in India are paying a very high import duty on raw material and semi-finished components. This has adversely affected the cost structure and competitiveness of the local industry in India and abroad.

Key advantages

The three big takeaways from the National Capital Goods Policy are: Emphasis on local manufacturing, focus on technology & standardisation, and integration with the umbrella theme.

Emphasis on local manufacturing: The policy aims to improve the overall contribution of this sector to 20 per cent from current levels of 12 per cent of total manufacturing activity by 2025. The idea is to increase India?s total demand from 60 per cent to 80 per cent, with exports increasing from current levels of 27 per cent to nearly 40 per cent. This initiative is expected to make India a dominant exporter of capital goods. Further, the policy attempts to facilitate improvement in technology depth across the value chain, train and harness better skills in the sector, improve standardisation, improve financial assistance to the sector and help in capacity building.

Focus on technology & standardisation: This policy will address the larger issues of technology transfer, purchase of IPRs, designs etc. Commercialisation of research will be encouraged through a specific budgetary allocation. The policy proposes to set up a startup centre for the sector with participation from the private sector to provide technical, business and financial support.

Another major element of the policy is mandatory standardisation according to which minimum standards would be defined. This initiative would go a long way in improving quality of products. More research institutions are also proposed to be set up. It will improve the overall manufacturing ecosystem in India.

Standardisation and improvement in quality will make a lot of MSMEs globally competitive. Acceptance will improve and business will become robust - strong cash flows, forex earnings, investible surpluses and profit retention.

Integration with the umbrella theme: Under the larger umbrella initiative of ?Make in India?, ?Skill India?, Smart Cities etc, this policy fits in very well. The big idea of making in India is about creating 2.5 million additional jobs every year, and also reduce forex outgo. If implemented well, the fit looks perfect.

Impact on the sector

The present administration has cleared a lot of stalled projects. However, more needs to be done for demand off-take. The policy addresses core issues on technology, skill, quality, standardisation, and easing of some controls on core sector businesses. This will help to some extent in the short term. Over the medium term, this policy should address issues of cheap working capital for the industry, reducing documentation, simplifying procedures for bringing in fresh capital, relook at inverted duty structure etc.

Investments will come in when these issues are addressed. The success or failure of NCGP will depend on the way a new ecosystem will emerge. The numbers projected look very ambitious. However, a lot will be achieved even if 50 per cent of projections are met.

There are three policy/change initiatives that could possibly be considered:

Technology gaps exist in many capital sectors, particularly in machinery manufacturing. Investment that comes by way of technology should be given special consideration by allowing investors to quantify technology as equity infusion into the business here in India. In special cases, 100 per cent FDI status should be allowed for investors.

A separate national fund should be created for investments under a ticket size of $50 million of Indian SMEs. These SMEs should get financed at special rates of interest and they should in turn justify it through strong export performance. They should also consume at least 50 per cent of the material or engineered components from Indian vendors.

A marketing consortium of Indian vendors is needed, with equity participation from the government, which can take Indian capital goods abroad and promote them aggressively and consistently.

At an overall level, it is a timely, well-intended policy (I would like to think work in progress). Implementation is going to be critical.

The author is CEO, Feedback Consulting, a market research-based consultancy that has helped more than 4,000 companies enter or expand in India.

+91-22-24193000

+91-22-24193000 Subscriber@ASAPPinfoGlobal.com

Subscriber@ASAPPinfoGlobal.com